Social Security number security is more important than ever. Scammers and identity thieves are always on the lookout Social Security numbers because they include a lot of personal information. Protecting this sensitive data requires aggressive actions.Scammers prey on naive people in our linked society. These scammers steal Social Security numbers via phishing emails, phone scams, and even sophisticated hacking. This information might ruin your finances and personal life.

The worst part is yet to come: sadly, scammers frequently target seniors. The main reason is that fraudsters see older persons as more susceptible owing to cognitive decline and technical inexperience. As a senior woman myself, I’ve been advised by financial pros to watch out for this danger – but how?

To safeguard your Social Security number from various risks, you need professional advice. Let’s look into eight professional techniques to protect your Social Security number and stay safe!

Share Your SSN Carefully

Be careful while sharing your Social Security number. Proactively protecting this sensitive data reduces the possibility of illegal access. Only share your Social Security number with respectable entities. Assess the organization or person asking your number before giving it. Consider other identifying techniques or whether the information is essential before sharing.

Ask yourself whether giving your Social Security number is necessary. Ask why and try other methods of identification or verification. Avoid exposing sensitive information by being careful and discriminating. In addition, keep any physical copies in a safe place. Lock your file cabinet or safe to avoid theft of identity, and destroy any physical copies you don’t really need.

Digitally securing your Social Security number needs additional steps. Online accounts that include your Social Security number should have strong, unique passwords. Enter your Social Security number only on secure websites (for example, look for “https” in the URL).

Use Phones and Emails Carefully

Scammers may often try to get your Social Security number by calling and emailing. You may avoid these deceptions by being cautious and suspicious.

Maintain mistrust when getting unwanted calls or emails. Scammers pretend to be authentic to earn your confidence. Avoid providing critical information to unexpected inquiries.

Verify the caller or sender’s identity before sharing personal information over the phone or email. Request account numbers and transaction history from reputable entities. Contact the official contact information from a reputable source to verify the correspondence.

Avoid giving sensitive information, like your Social Security number, over the phone or email unless you initiated the interaction and are sure the receiver is legitimate. Legitimate enterprises realize the hazards and avoid obtaining sensitive information via these methods.

Inform yourself about scams and phishing: Know what fraudsters are doing. Poor language, frantic inquiries, and calls for instant payment are warning signals. Read government websites and cybersecurity groups to stay informed about new risks and fraud.

By being skeptical of unsolicited calls or emails, verifying callers or senders, avoiding personal information over these channels, and staying informed about common scams and phishing techniques, you can protect yourself from Social Security number scammers. Remember, online and offline security requires caution and knowledge.

Maintain Financial Accounts and Credit Reports

Monitoring your bank accounts and credit reports is essential for spotting identity theft. Stay cautious and aggressive to quickly react to suspicious situations and secure your Social Security number.

Review bank statements, credit card bills, and online payment accounts regularly. Check every transaction for errors and unlawful charges. Report unusual activity to your banking institution immediately.

Several financial organizations offer account monitoring and warning services. Use these capabilities to establish alerts for suspicious behaviors such as significant transactions, contact information changes, and account logins from unusual places. These notifications might indicate security threats.

R your credit reports from companies such as Equifax, Experian, and TransUnion every year. Examine these reports for errors, unknown accounts, and improper credit requests. Report and address inconsistencies quickly.

Respond immediately if you observe suspect activity on your bank accounts or credit reports. Report the occurrence to your financial institution, freeze or cancel impacted accounts, and follow their instructions to minimize damage. File a police report and contemplate a fraud alert or credit freeze.

Protect Your Mail and Documents

To protect your Social Security number and personal information, secure any physical papers and correspondence. Security techniques and intelligent decisions may protect your physical documents and communications.

Safeguard critical documents: Lock up passports, Social Security cards, and bank statements. Avoid illegal access with a home safe or secured file cabinet. This prevents data theft and illegal entry.

Before dumping personal papers, shred them carefully. This includes previous bank statements, credit card bills, medical records, and other documents with your Social Security number. Shredding these papers prevents identity thieves from assembling your personal information.

Use a P.O. Locked mailbox/P.O. Box. This avoids mail theft and unwanted data access. To avoid attention, collect mail regularly.

Instead of physical papers, use electronic assertions and conversations. Electronic statements limit the volume of personal correspondence and the possibility of interception. Strong passwords and two-factor authentication secure your email and online accounts.

By locking mailboxes or P.O. Boxes and electronic correspondence, protect your Social Security number and personal information.

Learn Social Engineering Methods

Scammers use social engineering to get your Social Security number. By learning these methods, you may secure your personal information and avoid fraud.

Familiarize yourself with fraudsters’ social engineering methods. These include imitating trustworthy institutions or persons, creating a feeling of urgency or terror, and flattering, or abusing human emotions. Knowing these strategies helps you see red flags.

Beware of impersonators and manipulation: Avoid those claiming to represent legitimate organizations, government agencies, or financial institutions. Scammers utilize these methods to win confidence and get personal information. Verify identities before sharing important info.

Scammers use personal information, including your Social Security number. Learn how identity thieves may utilize your data. This knowledge will help you understand the necessity of data protection and security.

Remain abreast on new scams and security measures: Scammers adapt to remain ahead of security. Follow government websites, cybersecurity blogs, and news outlets for the newest frauds, phishing attempts, and security measures. You can adjust to new dangers with this information.

Avoid Public Wi-Fi and Online Transactions

Protecting your Social Security number and personal information on public Wi-Fi networks and online transactions is crucial. Secure techniques reduce data theft and compromise.

Avoid accessing important information on public Wi-Fi networks: Cafes, airports, and hotels commonly have unprotected Wi-Fi networks that hackers may use. Avoid accessing sensitive data like your Social Security number on public Wi-Fi. Avoid sensitive internet activity until you have a secure network connection.

Use secure websites for online transactions, including personal information. Certain websites include a padlock emblem and “https” in the URL. Encrypted websites reduce the danger of data interception.

Before inputting essential data like your Social Security number, double-check website security. Make sure that the website has an SSL certificate, encryption, and data privacy rules. Avoid untrustworthy websites.

A VPN encrypts your internet connection and hides your IP address, adding security and privacy. Even on public Wi-Fi, a VPN encrypts data. Protect your online activity and sensitive data with a reliable VPN.

Avoiding public Wi-Fi networks for sensitive activities, using secure websites for online transactions, double-checking website security, and considering a VPN can help protect your Social Security number and personal information.

Immediately Report a Compromised Social Security Number

If your Social Security number has been hacked, you must act immediately to limit the damage and protect yourself. Acting quickly and properly may reduce the damage and protect your identity.

Contact law police and the FTC if you feel your Social Security number has been hacked. Report the event for guidance. Inform your banks, credit card companies, and government authorities.

Check your bank accounts, credit cards, and online payment systems for unusual activity. Track transactions, withdrawals, and account changes. Check your main credit reports for fraudulent accounts and inquiries.

Consider a fraud alert or credit freeze to safeguard your credit reports. A fraud alert alerts creditors to check your identification more carefully, while a credit freeze blocks access to your credit reports. These restrictions make it harder for identity thieves to create new accounts.

After taking urgent action, be attentive and keep protecting your identity. Review your bank records, credit reports, and strange emails, calls, and demands for personal information. Maintain strong passwords and activate two-factor authentication wherever feasible.

Improve Online Security and Passwords

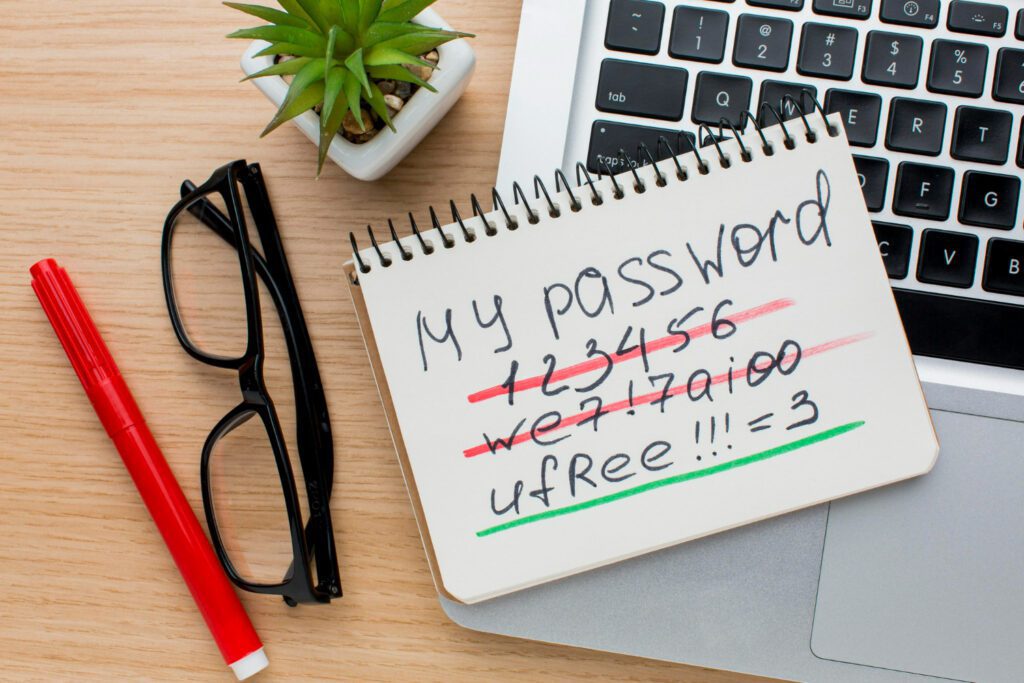

In the age of cyberattacks, password security is crucial. Implementing strong procedures reduces the possibility of illegal access to your Social Security number and personal information.

Choose strong, unique passwords. Use capital, lowercase, numerals, and special characters. Avoid frequent nouns and birthdates. Password managers can safely create and store complicated passwords.

Two-factor authentication secures online accounts. This feature adds a stage to password verification. Biometric verification, SMS message codes, or authenticator apps may be used. Even with a leaked password, it dramatically minimizes unwanted access.

Maintain internet security by updating software and devices regularly. Software fixes typically fix vulnerabilities. To stay protected against risks, enable automatic updates or check for and apply updates often.

Use secure networks while accessing your Social Security account or performing financial transactions online. Avoid public Wi-Fi, which may be hacked. Use encrypted networks like your home or VPN to protect your data.

You can protect your Social Security number online by strengthening your passwords, using two-factor authentication, upgrading your software and devices, and using secure networks. These simple yet effective steps protect your data online.

Conclusion

Protecting your Social Security number is crucial to preventing identity theft. This article’s professional advice may greatly lessen the chance of your Social Security number being stolen.

Keep in mind that your Social Security number provides access to your personal and financial information. It unlocks accounts, rewards, and sensitive data. It protects your identity and prevents money loss and reputation harm.

Emphasize the importance of following expert protection advice: The expert suggestions in this article are based on vast expertise and insights from field specialists. They provide efficient ways to protect your Social Security number from fraudsters. These suggestions strengthen your defenses, improve online and offline security, and lower identity theft risk.

Staying ahead of fraudsters demands aggressive actions. Review and update your security policies, remain aware about new frauds and approaches, and learn about dangers. Protect your Social Security number and personal information by being watchful and proactive.

Finally, securing your Social Security number needs constant vigilance. No matter how safe you may feel, I promise you it’s better to be safe than sorry!